Before diving deeper into the details of how a digital enterprise leverages its internal data more effectively, let us define the characteristics of internal data. Internal data are fully maintained and processed by the company, including master data with their life cycle and transactional data. Stability of models and low modification rates are major properties of master data, such as partner, product type or account. Examples of transactional data include payments and buy/sell transactions.

Transactional data do not exist independently; they always relate to associated master data.

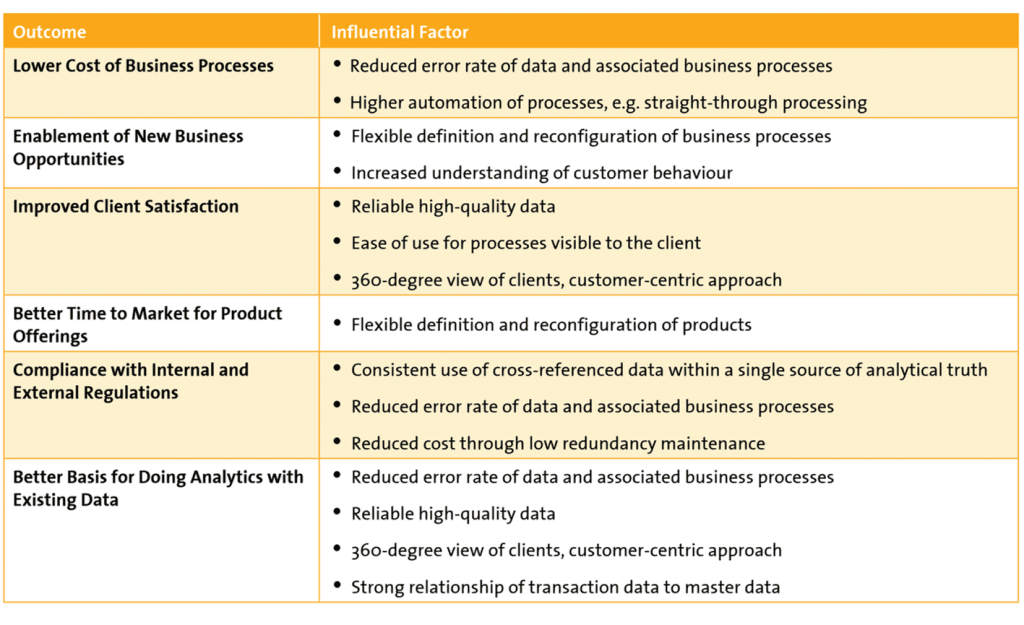

Often regulatory requirements define the scope and retention period. Truly digital enterprises regard internal data as real assets. The table below visualises the major drivers of business outcome.

It is worth giving thought to Master Data Management (MDM), in particular in the Partner and Product domains. Typical shortcomings in the Partner domain include disparate data, inconsistent data, duplicates and only subsets of partner data being available to applications and client-facing staff.

As a consequence, cross-selling across divisions will be limited or platinum clients might be approached as normal clients. Instead, a full partner view with complete transaction history is required. This will enable analytics processes, resulting in proposals known as ‘next best action’. Clients will notice!

The Products domain represents a company’s offering to the market, to existing and future clients. This is not only about material articles such as machines, computers or cars, but also about offerings: services, insurance policies, bank accounts, maintenance contracts and many more. What is often wrong today? It takes too long to make a new product available. Products cannot be tailored to changing needs. They may no longer be sold to clients for regulatory reasons. In other words: time to market and flexibility are affected. What is needed is an infrastructure that defines base products in terms of properties, price and reporting options, with the ability to combine them into composite offerings: bundled insurance policies, or contracts for financial services that include a current account, savings account and credit card.

Combined with workflow and rule engines, suitability and availability properties could be added. As an example, particular banking products may only be offered in specific regions.

Assuming MDM is in place and runs smoothly, the company will know its clients well and be aware of their needs, clients will enjoy an excellent service and new products will be brought to market in a timely fashion.

Done? Unfortunately, not. Data quality will decrease over time, data duplication will happen and data will become inconsistent, all with negative impacts on services and offerings.

Governance is the proven way to tackle this process. With governance, compliance of data with external and internal regulations is addressed, as is ultimately also the quality of data. External regulations are widespread in, but not limited to, financial services and pharmaceuticals.

What about typical issues with data governance rules, procedures and controls? Here we list a few. Does anyone know about data governance in the company? Or care? Or think that it helps in daily work? Or are these procedures simply regarded as optional or a kind of bureaucracy? Instead, digital enterprises have taken the step to ‘live’ data governance, day after day.

It is not a one-time effort and then you are done. This actually is the hard part.

What is needed is an authority that teaches the rationale and the right use of rules and regulations and defines rights, duties and sanctions. Without senior management support, governance will not happen.

Many enterprises live up to rules of data governance already, at least in parts of the organisation. For instance, effective master data management is crucial in finance and risk departments to support common business understanding and the definition and consistent use of KPIs to measure success and risks. The underlying concepts need to be expanded to a company-wide initiative and must be woven into a business-as-usual practice to keep quality of data at the highest possible level.

Does governance pay off? In today’s world, it can become very costly not to be compliant with rules. For the financial services industry, for example, you will have read this in the news much too often. Is governance therefore only about avoidance of negative situations?

Certainly not. Based on managed data quality, automated business processes will run more smoothly and rule engines will navigate correctly through decision trees. Intensive use of data will pay out and awkward situations, such as in customer support errors, will be less likely. This is the secret of digital enterprises – they leverage MDM solutions, reassess the level of data quality regularly, enable access via easy-to-use and easy-to-find services, avoid or at least reduce redundancy and inconsistency, and have a higher degree of automated system integration than other companies.

How do you get there and become a truly digital enterprise?

Goals, business value, scope, timeline, budget and approach should be clear to, and agreed with, all stakeholders and affected parties.

With constant discussions about these parameters, change programmes are doomed to failure. Clear identification of business processes to be renewed, improved or automated will help significantly, along with the requirements for internal data, their services, and rule and process engines.

Deliver quickly: Pilot projects or proofs of concept always make sense, but only if they represent and implement a reasonable subset of business functionality. Otherwise, gaps will be encountered in a later stage in the ultimate solution, at higher cost. Be careful with solution components that do not yet support the required technology or functionality. Their release plans may change for the worse, and this might have a significant impact on the journey to becoming a digital enterprise.