As discussed in the previous sections, the digital transformation of an enterprise requires a comprehensive reinvention of its business model. Such business model reinvention encompasses all its dimensions.

In the context of Osterwalder’s Business Model Canvas (BMC),[1] the Value Proposition dimension of the BMC is the focal point. New value propositions are created in the digital transformation and existing ones might become obsolete, because they lack competitiveness against new digital competitors and/or need to be phased out to enable the enterprise to focus strategically. In other words, the existing business portfolio needs to be revisited. Individual elements of the business portfolio can also be described, using the BMC approach, as slices of the overall business model.

Developing a long-term digital strategy requires a realignment of the existing business portfolio to match the digital world, leading to transformations in various areas, such as the value chain, digital businesses, the various product lines and regions.

To launch such a realignment, the individual businesses of the overall enterprise portfolio must be categorised according to their strategic relevance in the light of digitalisation.[2] This is core to the enterprise’s strategy process.

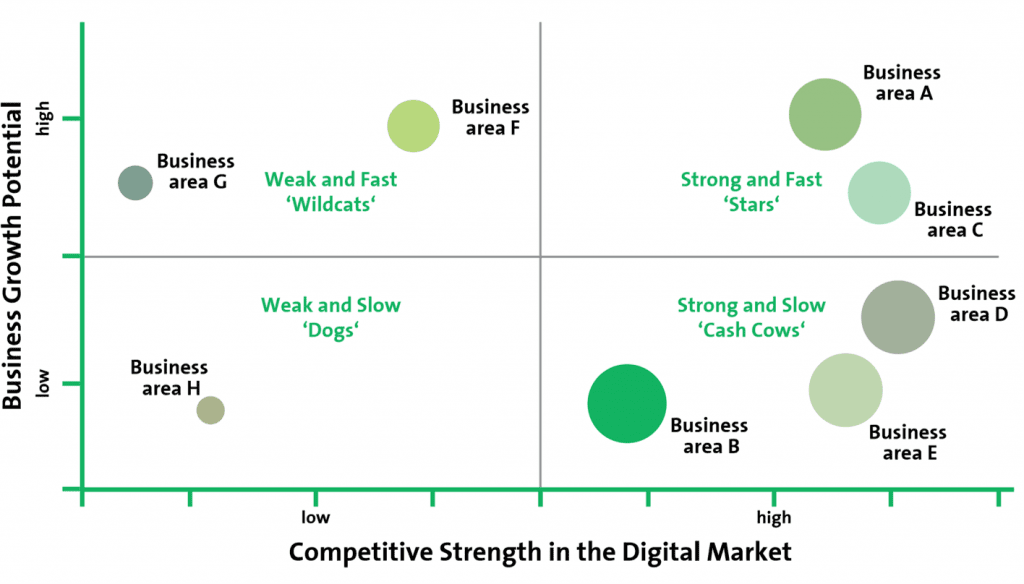

One possible categorisation would be to depict the business growth potential of a business line versus its competitive strength in a digital market.

The following diagram shows an example, the size of the bubble representing the business lines’ turnover. Four quadrants can be distinguished here: Cash Cows are competitive in the digital world, but have no growth potential (lower right), while the Dogs have neither competitive strength nor do they represent a business growth opportunity – these are candidates to exit (lower left). Business growth can come from the classical business units, the Wildcats fighting for survival (upper left), or from the digitally competitive Stars (upper right). This proposed classification can be replaced with others, as appropriate; for example: digital market growth potential vs. ability of the enterprise to adjust to the new market conditions; market growth potential vs. profitability of the associated digital business.

Once the business portfolio has been analysed, the enterprise will undergo the digital transformation process. It is clearly impossible to adjust the value propositions (products and services) instantaneously. The enterprise would not survive the transformation process. The revenue streams based upon the former value propositions must be maintained to finance the transition to the new value propositions. The business must maintain a careful balance between old and new over the multi-year transition.

Close cooperation between the CDO, CFO and individual lines of business must be maintained to determine an optimal, balanced approach to portfolio transition.

Ideally, the enterprise will have sufficient time in hand to optimise risk – return for the transformation.

In a rather different scenario, the enterprise may find itself in a position where it struggles fundamentally at the outset of the transformation and has to take the bold decision to limit traditional product lines in order to generate the financial means for the digital transition. The business portfolio management paradigm still holds good, but more drastic measures need to be taken. In such a scenario, the enterprise does not have the luxury of a careful transition. Even more so than in the normal approach, close risk management, change management and executive attention are required to accompany the transition.

Business portfolio management becomes an operational instrument for executive management. The transformation plan for the overall enterprise business model is derived from business portfolio considerations. Following the analysis of the portfolio, the tactical business portfolio decisions drive a sequence of steps in the business transformation, which are implemented as projects. Projects investing in non-strategic businesses must be revisited, providing potential to free up funds for the digital transformation. It is also essential to closely monitor the actual development of both the remaining and the new lines of business, as deviations from the planned path are significant and can be disastrous. There is little alternative to boldly following the strategic path.

Linked to business portfolio considerations, several fundamental accompanying adaptations must be implemented, starting with modification of the enterprise architecture (EA). This EA modification in effect constitutes the comprehensive internal digitalisation transformation programme. Both organisational and cultural transformation will need to be implemented.

The skills necessary to implement and run the new digital businesses must be acquired and the whole enterprise’s mindset must be shifted towards the new digital paradigm.

The efficiency of implementing change must be improved and resources must be reallocated to support the new business portfolio.

It is also important to return to BMC and EA considerations to keep the transformation balanced, but all these changes are necessary for a proper redirection of the business architecture.

Finally, an enterprise pursuing digital transformation should always consider the maximum speed at which the organisation is able to go and adequately adjust the reinvention of the business model. The speed of change must be gauged according to the organisation’s capability to implement and digest change. Certainly, considerable transformation momentum can be generated even in a rather complacent organisation by appropriate change management, but one must not endanger the business portfolio transformation by attempting the impossible.

‘Think big, start small’ is the right approach.

_____

[1] Osterwalder, A., Pigneuer, Y.: ‘Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers’, John Willey & Sons, 2010.

[2] Moore, S.: ‘Strategic Project Portfolio Management: Enabling a Productive Organization’, John Wiley & Sons, 2009.