Indigo Digital is a Zurich-based fintech start-up. The purpose of the company is to bring financial inclusion to the unbanked and underbanked via fair, affordable and standardised mobile-based financial services.

Standardisation drives down costs and Indigo passes on the benefits of the advantageous cost structures to its clients.

Imagine a Moroccan mother with five children living in the Atlas Mountains; her husband works in Lyon and transfers money to her every month with a 10–15% transfer cost. In contrast, Indigo offers international transfers that cut the mix of high fees and unfavourable currency exchange rates typically taken from underprivileged customers. Indigo can do this by creating local ecosystems of commercial partners that promote the widespread acceptance of low-cost mobile payment services.

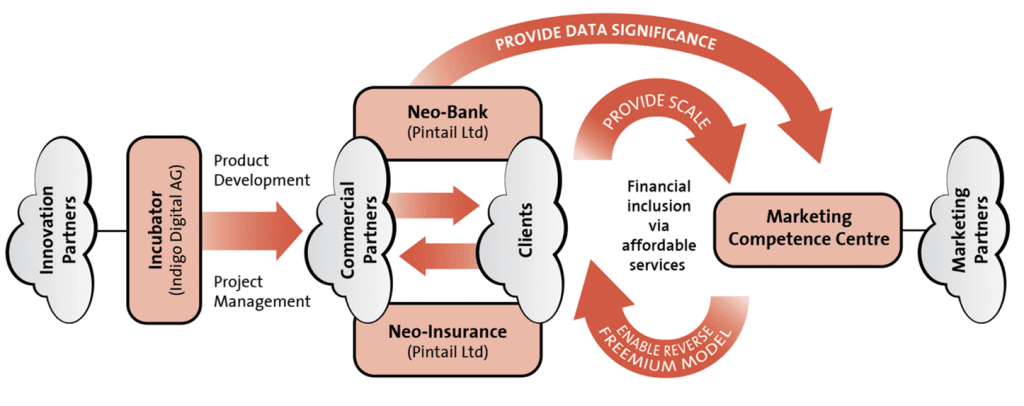

Indigo Digital Group comprises the Zurich incubator for project management and innovation, the neo-bank Pintail, and a marketing competence centre. The marketing competence centre generates revenues from innovative marketing models and enables a freemium business model in the neo-bank. It drives the profit of the company, while the neo-bank provides affordable financial services. Cooperation with partners via innovative commercial models is at the heart of Indigo Digital’s business model. Mobile payments, for example, have fee structures vastly better than credit cards, and these benefits can be shared between merchants and customers.

Indigo Digital is built up as a virtual company collaborating via various technology innovation partners in banking platforms, modern mobile front ends and state-of-the-art security platforms.

Taking virtualisation to the maximum, Indigo Digital can speedily create ecosystems at a macroscopic scale, leveraging the existing interfaces of its partners.

The group has a very lean internal management structure in order to drive local entrepreneurship in the countries served.

Unusual in the digital economy, Indigo Digital is a public–private partnership, endorsed by international organisations such as the United Nations and the International Organization for Migration. This set-up opens doors to governments, e.g., development aid ministries, as well as private organisations in their corporate social responsibility (CSR) engagement. Indigo has a radically open and pragmatic approach to collaboration models with innovation, commercial and marketing partners, and hence can easily form macroscopic ecosystems. Together they have a wide geographic spread from the outset – their business idea thus scales massively across geographies.

Truly putting customers at the core of the business sets Indigo apart from standard players in the financial services industry.

Indigo is targeting a business model with genuinely low-cost financial transactions in order to support the weakest and most underprivileged customer segments.

It does not take advantage of their weak economic situation, instead reducing costs and fees as much as possible by employing state-of the-art mobile technologies.

Also, contrary to many of the incumbents, it promotes a free flow of innovative ideas and can quickly respond to them in an undogmatic way.

The key skills in Indigo’s organisation that set it apart from traditional players are the combination of entrepreneurship with a thorough understanding of the financial services fabric.

This includes the understanding of true global value chains, technical architecture and project management expertise in the context of multiple implementation partners, and strong social competencies that quickly build novel cooperation models.

To Indigo, digitalisation means bringing novel mobile-based financial services to developing countries based upon the widespread use of mobile devices in those societies.

Indigo maximises straight-through processing with commercial partners to reduce transaction costs, while employing the latest technologies.

In order to compete in the digital age, one critical success factor is providing room and support for the true entrepreneurship of every employee.

Business, technical, commercial and social skills are then combined to drive a cloud of cooperation partners. And humility is essential to deal effectively with other cultures.

Indigo Digital’s business model is enabled by the widespread availability of smartphones in developing countries, state-of-the-art security technologies to make mobile banking and payments safe and the acceptance of digital solutions in these economies that leapfrog solutions in developed countries. An example is the usage of credit and debit cards. While these are a well-established means of payment in developed countries, it has never broadly spread in the developing world. Mobile payment schemes now have problems replacing cards in the developed world, but still find broad acceptance in other parts of the world. Indigo also deploys novel techniques to analyse customer behaviour and enable innovative marketing services.

Indigo did face challenges and issues in building its business.

Firstly, it had to find implementation partners to share risk and engage in models that move costs to the later success stages of the enterprise, with the reward of upside participation.

As a bank, it requires a fairly complex IT infrastructure and had to find innovative ways of financing the IT build-up. Secondly, Indigo needed to match the cultures between the central incubator and each country’s ecosystems. As a small team in the incubator, exposure to these environments is immediate. It is, however, very gratifying to experience the entrepreneurship in such upcoming economies, for example Morocco, at a level sometimes missing in saturated developed countries. In addition, Indigo needs to keep the seed-financing pipeline constantly open while consequently driving forward build-up efforts. As stated above, building a neo-bank with macroscopic local ecosystems requires stamina and persistence.

Indigo Digital is at the heart of multiple digital networks; the very basis for a successful digital business is the creation of such ecosystems.

Across geographies, multiple local mobile payment ecosystems and micro-product ecosystems are created. It is the speed with which Indigo can create such networks that so distinguishes it from the competition and drives the company’s growth. Societies, to the benefit of all stakeholders, are moving to cashless payment systems. Indigo believes that mobile technology will also lead to peer-to-peer payment systems that do not require the use of credit cards, taking away the fees currently paid in such systems.

Fair financial services, accessible to everyone, do exist.

It is Indigo’s pleasure to drive these trends forward for the benefit of customers.