Hiscox was founded in 1901 and is an international insurer headquartered in Bermuda, and listed on the London Stock Exchange (LSE:HSX).

The group has three main underwriting divisions – Hiscox London Market, Hiscox Re and Hiscox Retail (which includes Hiscox UK and Europe, Hiscox Guernsey, Hiscox USA and the subsidiary brand DirectAsia).

The group underwrites internationally traded, bigger-ticket business and reinsurance through Hiscox Re and Hiscox London Market. Through its retail businesses in the UK, Europe and the US, Hiscox offers both personal and commercial insurance policies. For individuals, Hiscox provides home and contents insurance for ‘higher-value’ houses, as well as classic cars, fine art, kidnap and ransom, and personal accident coverage. For companies, coverage types include property, marine, aerospace, professional indemnity, cyber and political risk insurance, as well as reinsurance. The company generated total revenue of £1.79 billion in 2016, with a profit of £0.33 billion.[1] In March 2014, Hiscox acquired the direct-to-consumer online operation, DirectAsia.[2] In October of the same year, Hiscox USA launched a new brand platform, ‘Encourage Courage’.[3]

In line with the general shift of the insurance industry towards digitalisation, Hiscox started with its own digital initiative in the very early 2000s. According to its market analysis, Hiscox defined a short- to mid-term roadmap.

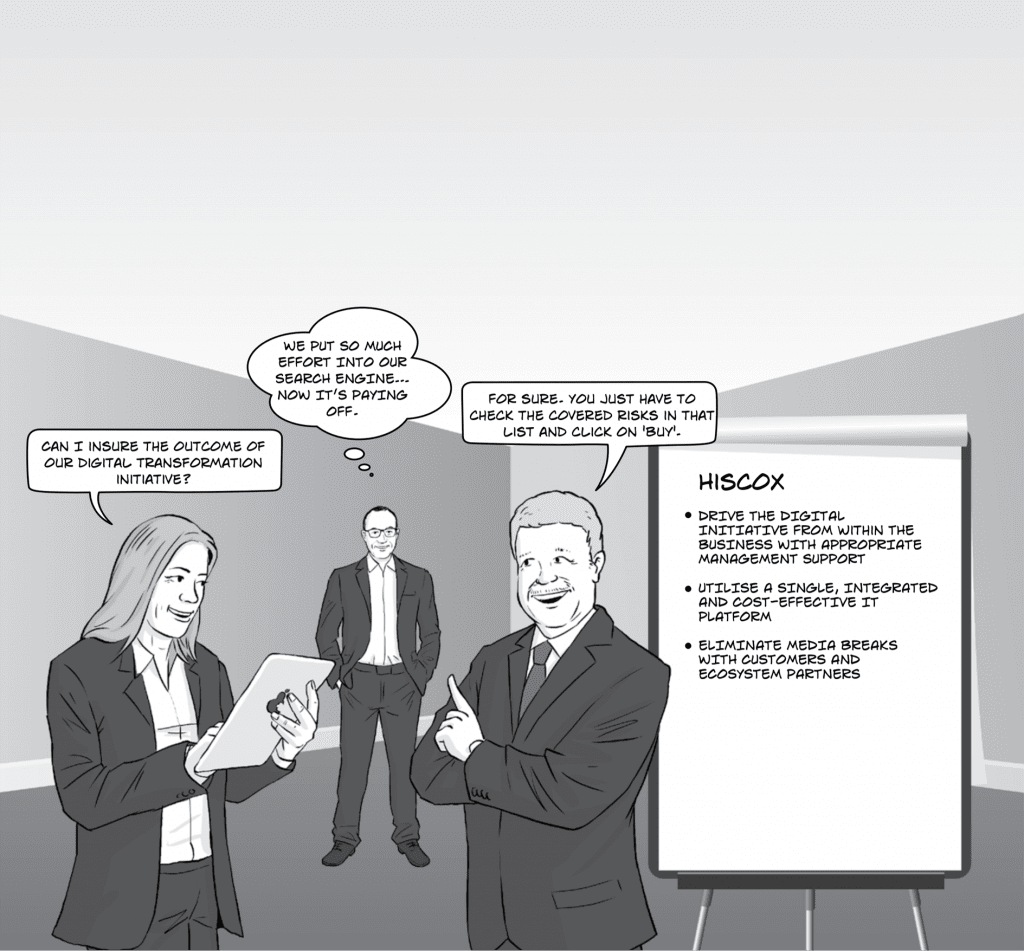

The goals were not only to rapidly define new insurance products while providing pleasant and intuitive online processes to customers, but also to eliminate media breaks among all participants, to improve online marketing via search engines and to streamline back-office processes.

Hiscox’s digital initiative was driven from a business perspective with clear business goals in mind and respective management support at all levels of the organisation.

The first step towards digital product innovation was taken in the UK with extranet and direct sales websites, which were then expanded to France, Germany and the US. Hiscox modularised its product offerings and implemented a flexible product engine that allowed automated underwriting. As a result, the final process was extremely convenient and led to a new quality of customer experience.

It enabled clients to finalise a policy in one online session and tailor the product exactly to their needs by dragging coverage options into their shopping basket.

Hiscox merged the digital activities of its direct and indirect business under a common management in 2016, and defined a long-term roadmap comprising a European Internet distribution platform and a continuous back-end process optimisation programme towards a digital, paperless office.

On the IT side, Hiscox started its digital initiative with extranet and direct sales websites implemented on top of their core policy management system. However, Hiscox needed a flexible platform to pursue its initiative and to substantially grow its direct business.

Hiscox perceived the market conditions to be highly volatile.

As it was unpredictable what digitalisation would bring, Hiscox was looking for a flexible platform that would ensure it was well prepared for rapid and flexible reactions to future digitalisation requirements. Hiscox chose Prima Insure[4] – a development framework for insurance applications comprising a predefned business object model, a product workbench, web services and business process management capabilities. Prima Insure is available in hosted mode, which allows for rapid project set-up. Hiscox’s first project with Prima Solutions was conducted in 2013 for the Internet distribution platform of Hiscox France, and it launched its first product within three months.[5]

Hiscox’s ability to quickly set up new products online and provide customers with online capabilities was key to the success of the digital initiative. The speed was made possible by using one single software platform that enabled Hiscox to configure the product rating and underwriting rules, customise the underwriting, policy issuance and financial processes, implement the online sales channel, localise the platform for different countries, test it and put it into production – all in one place. The utilisation of cloud services, a preconfigured service backbone and a product workbench additionally increased the efficiency of IT delivery. However, it was not merely the technology. Prima Insure was the catalyst for a new project culture at Hiscox, characterised by speed and agility.

Speed is a critically required skill; however, it is not the only issue. Process efficiency increasingly turns out to be a critical success factor. Particularly for products with a low margin, a fully automated and efficient process empowers Hiscox to offer competitive prices. This is not only a question of how profitable products are for Hiscox, but also the question of empowering Hiscox to enter new market segments that were out of reach with traditional, manual processes.

Hiscox demonstrated from its experience that speed and efficiency can only be achieved if distribution channels and back-office processes work seamlessly together, sharing data and business logic.

This in turn requires a comprehensive platform covering all disciplines of the insurance business.

In parallel to business product innovation and improvements to IT support, the comprehensive platform is also needed to replace ageing legacy systems, which create growing pressure to renovate the technology platform.

In addition, it should be mentioned that Hiscox is part of a larger ecosystem, including search engines, online pricing engines, social media and broker organisations. Each ecosystem partner requires particular attention as part of Hiscox’s digital strategy and respective IT interfaces.

Finally, we should look at the transformation of the business portfolio. At the beginning of its digital journey, a key concern of Hiscox was the risk of cannibalising its own business. This is a concern that should, in general, be taken seriously. However, in the case of Hiscox, their efforts brought about not only a further extension into existing customer groups, but also the development of new customer groups.

By utilising the digital approach, Hiscox can meet the needs of ‘digital natives’, who cannot be reached through traditional face-to-face channels.

_____

[1] Hiscox Group: ‘Interim Report 2016’, Hiscox Group, 2017.

[2] Agini, S.: ‘Hiscox To Acquire Consumer Insurer DirectAsia For USD55 Million’, Morningstar, 2014.

[3] McMains, A.: ‘This Business Insurer Surprisingly Applauds Risk Taking – New ads for Hiscox feature gutsy entrepreneurs’, Adweek, 2014.

[4] Prima Solutions: ‘Prima Solutions – Homepage’, Prima Solutions, 2016.

[5] Business Wire: ‘Hiscox France chose Prima Insure™ for its Internet distribution platform and launches its first product within three months’, Business Wire, 2013.