This section is based upon an interview with Ramin Niroumand, Co-Founder and CEO Managing director of finleap.

finleap is a group of entrepreneurial investors that built Europe’s leading financial technology ecosystem with the goal to reshape the financial services landscape in cooperation with partners, investors and top talent.

finleap’s ecosystem consists of a variety of category leaders across the financial services value chain, and includes companies both built by finleap and companies who joined via acquisition. With its headquarters in the vibrant center of Berlin, finleap and the members of its ecosystem are now all over both Germany and Europe. Although previously known mostly for building and scaling fintech companies, fiinleap now focuses on maximizing value creation and fostering innovation for all of the stakeholders in its ecosystem.

In 2014, the finleap team, led by one of its founders Ramin Niroumand, had the foresight to see that the European financial services landscape was going to and needed to be transformed by embedded, digitally-native financial services.

Legacy financial institutions at the time were often mired by regulation, slow to innovate and unwilling to profit from their own potential business lines.

Thus, the vision of digital disruption for finleap began with the then-unknown concept of company building. Where many others saw complexity and regulatory challenges, finleap saw the opportunity for a digitally-native ecosystem of companies. By combining the right resources – top talent, capital and technology – these opportunities were brought to life.

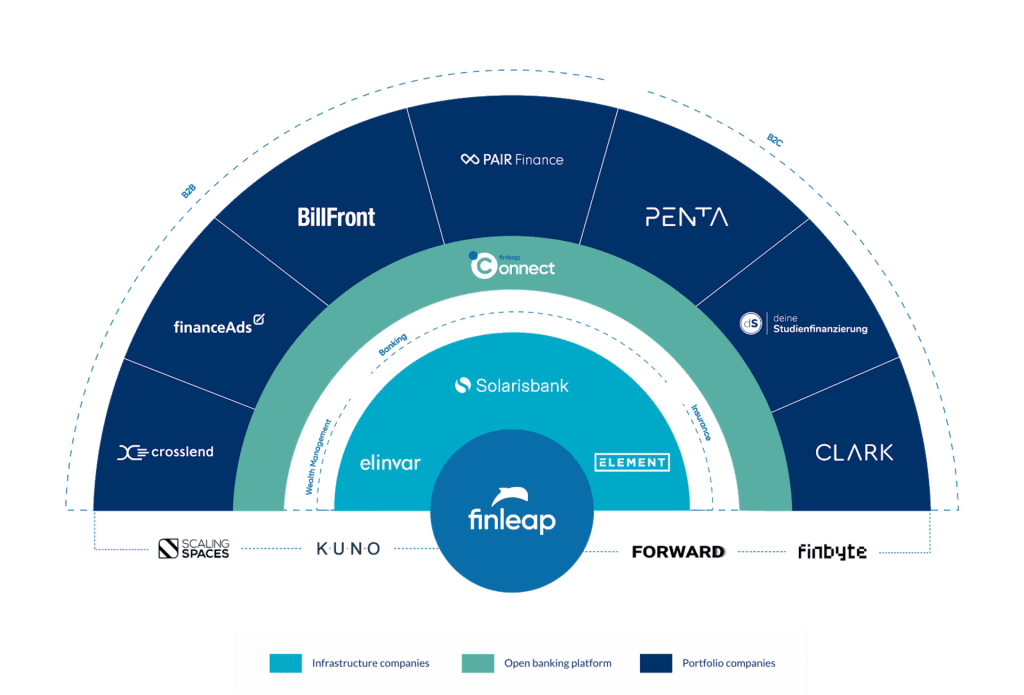

finleap’s ecosystem consists of three main types of companies: (i) infrastructure companies, (ii) portfolio companies including product and platform leaders as well as (iii) supporting experts for office space, administrative excellence or tech outsourcing.

- The most successful companies of the future will most likely fall into one of two categories: customer-facing platforms that act as digital financial platforms, or vertical winners that offer best-in-class financial products through these infrastructure platforms, by connecting them to their customers in a seamless and fully digital way. These companies can be enabled by finleap’s regulated infrastructure platforms ELEMENT, Elinvar and Solarisbank, which are technology companies equipped to enable any firm to transition into the future of financial services. They achieve this by offering fully regulated and ready-to-use white label insurance, asset management and banking products. Amongst our customers are well-known European fin & tech challengers and financial services players looking to maintain and expand their competitive edge in the market. These infrastructure companies are completed by finleap connect, a B2B2X, full-stack Open Banking platform that enables both parts of the finleap ecosystem as well as partners across industries to access and utilize financial transactions. By leveraging data services, these transactions can be enriched to deliver even more added value to partners. Both can be represented in finleap connect’s modular and customisable frontend solutions, ultimately delivering seamless, digitized financial services to customers.

- finleap’s portfolio companies consist of a broad range of fintechs and insurtechs that solve the pain points of consumers and business partners, including category leaders like the digital insurance manager, CLARK, business bank, Penta, and PAIR Finance – leader in digital debt collection.

- Finally, finleap’s ecosystem is supported by entities like KUNO, Scaling Spaces and finbyte, each of which provide services for and outside of the ecosystem. These services include back-office human resources and financial controlling, like in the case of KUNO, a flexible office renting company, Scaling Spaces, or a tech outsourcing platform, finbyte.

With a maturing fintech market on the horizon, one can certainly expect more consolidations, more financing rounds and a further development of embedded financial services in the industry to come.

This maturation decreases the relevance of company building, and increases the need for excellent portfolio and investment management capabilities. finleap has shifted its focus accordingly from building new category leaders, to supporting the portfolio and ecosystem of leaders it already has to foster further innovation in the financial services landscape.

After having launched a significant number of leading fintechs and insurtechs on its own and looking at a constantly maturing fintech market, finleap now further builds upon its comprehensive company builder expertise. In doing so, they combine finleap’s digital solutions and said expertise with the unique assets of its partners, such as industry insights, existing customer base and a strong brand.

With this approach, finleap brings corporate innovation to success by combining strategic vision, top talent, cutting-edge technology, knowledge, platform and network.

Digitalisation initiatives often fail due to shortcomings in the organisational and cultural context of the incumbent enterprise.

finleap strives to address this problem and provide a stable independent platform to develop; it provides a platform where digital entrepreneurs, finance professionals and tech experts as well as leading institutions can work together.

finleap sees two sides to digitalisation. On the one hand, it sees ‘bread-and-butter’ digitalisation – paper-based processes are transformed online and banking moves to mobile channels. Internal and external processes are improved and automated incrementally. On the other hand, and more radically, digitalisation has the power to create fundamentally new business models across classical company boundaries.

Digitalisation removes existing barriers to customers accessing financial services. Digital services can address broad segments of society and hence act as a force of democratisation.

As for organisational structures, finleap does not believe in the approach of focusing the digitalisation thrust to a limited part of the enterprise. The entire organisation must think digital; a new culture must be established for its full potential to be achieved.

As a critical success factor, digitalisation must first be accepted wholeheartedly as the very foundation of the new business model.

Then, digital ventures should be established taking a greenfield approach. And the organisation itself must adapt to the agile digital, technology-driven model. It must be modular to be able to develop at transformational speed and as such break away from classically monolithic structures and move towards micro services architectures. In financial services this trend is underlined by Open Banking APIs, scaling and embracing these will be key factors to long-term success. Given the crucial importance of being able to prove the identity of the customer in the regulated financial services arena (Know Your Customer or KYC requirements), the rise of video identification solutions presented a revolution. Now, the revolution has developed further with so-called digital KYC products, which reduce customer onboarding time to under three minutes via bank account verification.

Two category leaders within the finleap ecosystem, Solarisbank and finleap connect, have been at the forefront of this digital transformation with their BankIdent and eKYC products, respectively. Revolutionary products like these emphasise the transformational power of finleap’s ecosystem, digitising existing processes by combining digital and modular products.

By repeatedly applying integrated insights from past experiences, network and the market to grow its ecosystem, finleap continues to have a positive impact on the European financial services landscape and the world at large.

finleap accelerates this growth through close collaboration with its strategic and financial partners. Within a decade, companies will likely define the success of their business models not through benchmarking with traditional industry peers, but by how effective they are in collaborating with rapidly emerging digital ecosystems built across different sectors. To that end, finleap is already focused on maximizing value creation and fostering innovation for all stakeholders. Going forward, the new generation of startups can rely on a number of finleap ventures for the infrastructure and expertise necessary to succeed in the marketing, cementing finleap’s role as the leading European fintech ecosystem.